Commitment of Traders and Comex Inventory

Happy Saturday!

Precious metals enthusiasts who have participated in the market for any length of time will often tell you that the market is manipulated. There is lots of evidence that supports this theory, none more than the Commitment of Traders (COT) reports.

What are commitment of traders reports and what do they show?

COT reports detail how many long, short, and spread positions (long and short) make up the open interest. The report can be found on the Commodity Futures Trading Commission (CFTC) website, which reflects the prior week’s data (it has a one week lag). Basically the report is broken down into two main categories - managed money (hedge funds and the like) and commercials. Commercials can be producers hedging their price risk, which is what the futures market were designed for, and it is the bullion banks themselves who also happen to be the market makers.

Therein lies an inherit conflict of interest.

Commercials, or more specifically, the bullion banks have a seat at the poker table, same as other market participants. The difference is that the bullion banks not only see everyone’s hand but they set the market after seeing everyone’s hand. If you’ve ever played poker, knowing what your opponents have is akin to shooting fish in a barrel. Remember the old adage “the house never loses” which is in reference to a casino. Bullion banks, as the market makers, are the casino and they don’t lose, hence why they are the ‘smart money.’

Over the past few weeks, as the price of gold and silver have languished, the COT reports have reflected that managed money positions or the ‘dumb money’ is increasing their shorts (betting that the price goes down) while the commercials who were net short at the last local price high have covered their shorts, meaning that they are taking the long side (betting that the price goes up).

Knowing how the market is positioned is a key data point and when either side, managed money or commercials, is positioned extremely the price typically moves in the opposite direction. The latest COT data reflects that the recent price flush is, at the very minimum, due for a bounce and could be working on a longer term bottom. We are approaching extremes by the dumb money.

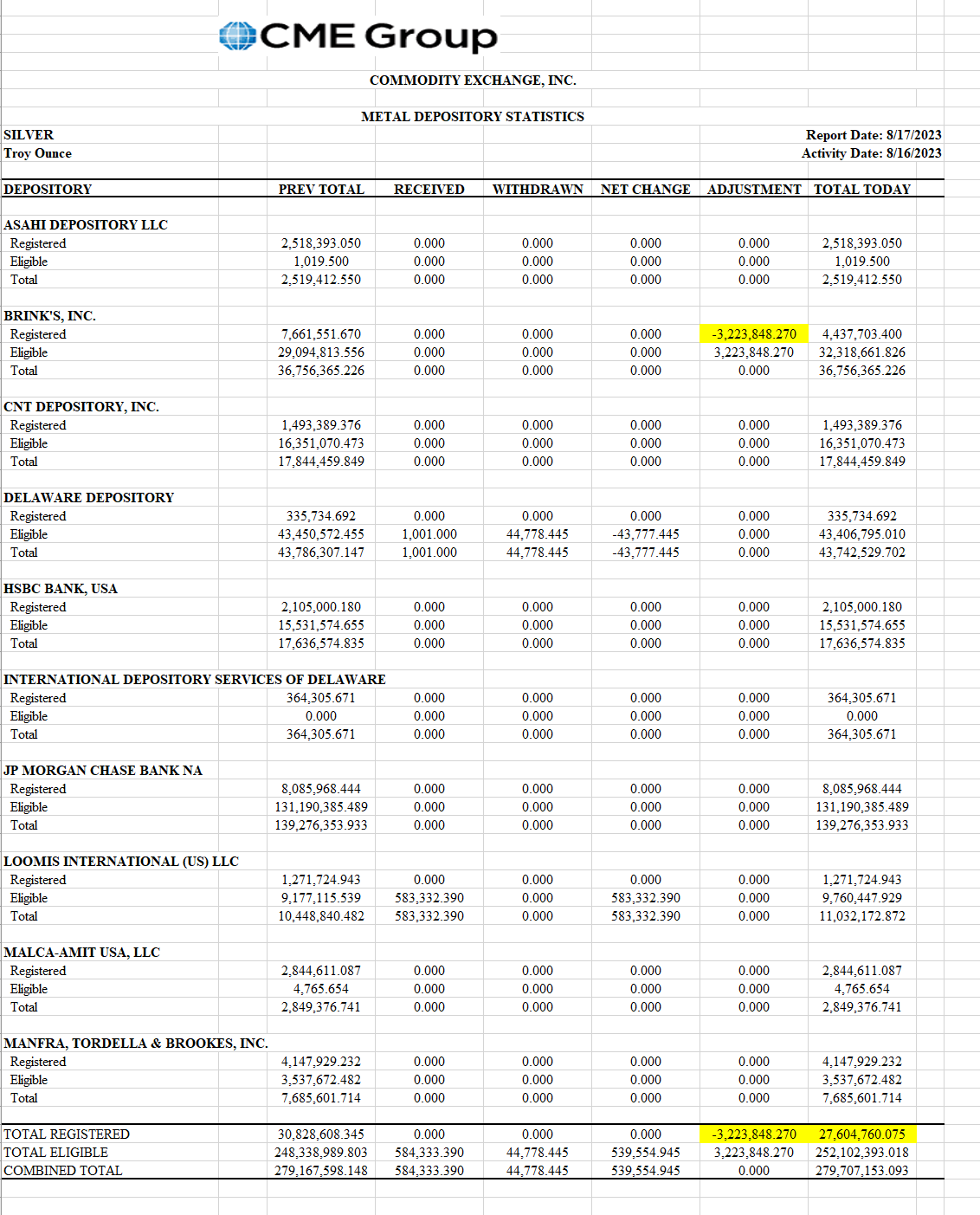

This brings us to the point of this post - can the bullion banks play this game in perpetuity, thereby suppressing true price discovery? We don’t think so and the reason is simple. If you are solar farm and need silver for solar panels, or if you are a sovereign central bank trying to increase your reserves in gold, you don’t want paper futures contracts - you need physical metal. True price discovery will happen when the paper charade ends because physical demand overwhelms the market. That may be approaching as just this week the largest warehouse of physical, the Comex saw a -10% reduction in silver inventory!!! TEN PERCENT!!!

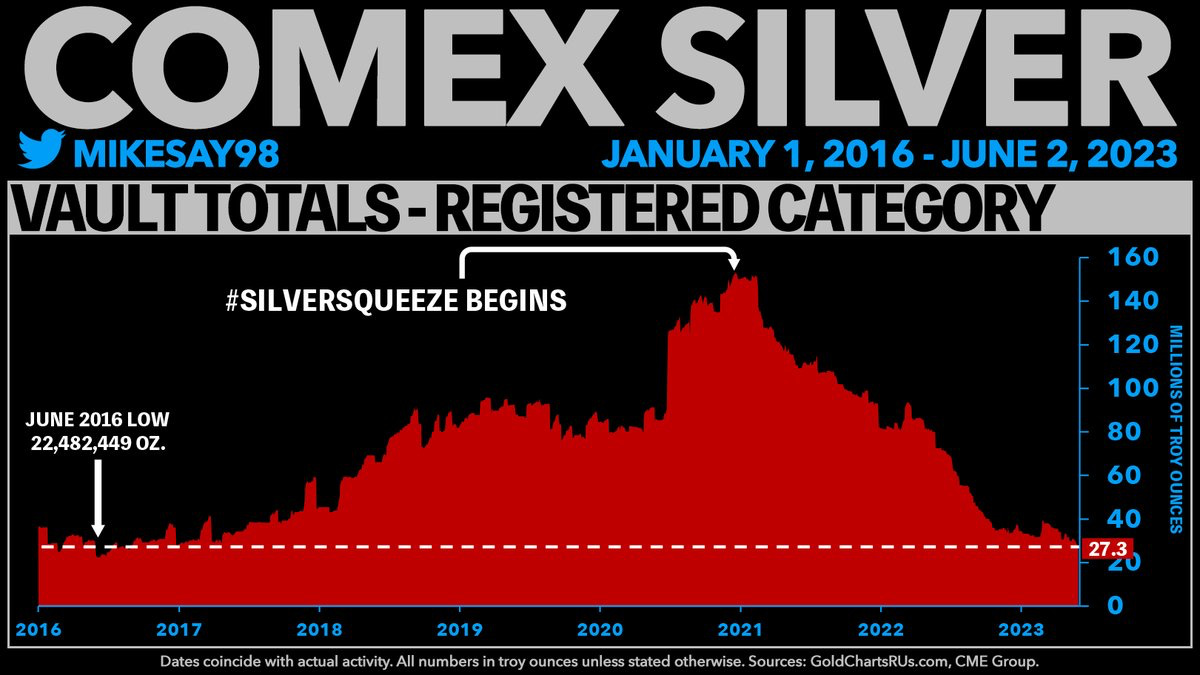

Folks, there are now only 27.6mm ounces of silver eligible for delivery to the global market at the world’s biggest precious metals warehouse. In February 2021 there were 150mm ounces of silver! That’s a cool -82% inventory plunge that has left the market. The following chart is dated 2.5 months but the above highlighted part shows the current inventory, which was similar back in June.

A billionaire or a decent sized hedge fund could corner the silver market like the Hunt brothers and Warren Buffet tried in years previous. All it would take is U$630mm dollars to absorb the entire silver inventory at the Comex warehouse. To put this number into perspective, the United States is running a U$1.5 trillion deficit this year alone.

Next week the BRICS nations are holding a summit where they plan to announce a new currency that is backed by precious metals to disrupt the US Dollar hegemony. Stackers are on the right side of history as this fiat monetary experiment that started when Nixon closed the gold window 52 years ago appears to be finally facing real competition. Will this be the start of price discovery? We shall see.

If you are interested in purchasing sovereign precious metals, please email us at silver@brazenbullion.com. Not only do we offer some of the best prices in Canada, we also provide buyer anonymity in that your name is not part of a registry so nobody will know that you own it.

As always, thanks for reading and keep on stacking!